how much child benefit and child tax credit will i get

How Much Is The Child Tax Credit. A refundable tax credit reduces or eliminates the taxes you owe at the end of the year.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

You must contact the Child Benefit Office if you.

. Number of children. That changes to 3000. Big changes were made to the child tax credit for the 2021 tax year.

This calculator lets you estimate the Canada Child Benefit you will receive between July 2022 and June 2023 based on your adjusted family net income AFNI reported on your 2021 tax returns. Only one payment your check is. The State Pension will rise too by up to 28860 a year and Universal Credit by as much as 18972 a year for couples.

This credit is part of Connecticuts 2022-2023 budget bill which was signed into law by Governor Ned Lamont in May. E-File Directly to the IRS. Those eligible for the credit will receive a rebate of 250 per child which is capped at three children for a total of 750.

The child tax credit can now be worth up to 2000 per child under 17. If your AFNI is under 32797 you get the maximum amount for each child. How much is the child tax.

Our calculator will give you the answer. For married couples and joint filers the credit will dip below 2000 if their. The maximum benefit per child under 6 is 6997 per year 58308 per month.

The percentage depends on your income. Amount of Universal Credit. Families can still receive child tax credits if eligible Credit.

The two most significant changes impact the credit amount and how parents receive the. If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each of your other children until they turn 16. We dont make judgments or prescribe specific policies.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. For a married couple filing jointly those amounts are 400k and 210k respectively. Who the allowance is for.

If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each of your. Parents E-File to Get the Credits Deductions You Deserve. Two Factors limit the Child Tax Credit.

For parents of children up to age five the IRS is paying 3600 per child half as six monthly payments and half as a 2021 tax credit. Under 6 years of age. To qualify for the maximum amount of 2000 in 2018 a single person must have an AGI below 200k or an earned income below 190k.

For any additional children the rate falls to. Get your advance payments total and number of qualifying children in your online account. Enter your information on Schedule 8812 Form.

For a child born in March 2023 you will be eligible to receive the CCB in April 2023 or the month. 28250 born before 6 April 2017 23708 born on or after 6 April 2017 Second child and any other eligible children. There are 2 Child Benefit rates.

The payment for the earned income credit or noncustodial parent earned income credit is 25 of the amount of the credit you received for 2021. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. Families could be eligible to get 205 for each.

Millions of families get child benefit though there are some exceptions to. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Ad Tax Strategies that move you closer to your financial goals and objectives.

Tax credits calculator - GOVUK. The taxpayers earned income and their adjusted gross income AGI. 6997 per year 58308 per month 6 to 17 years of age.

Claim Child Benefit Universal Credit How and when your benefits are paid Tax credits if you leave or move to the UK Help if you have a disabled child Tax credits. We provide guidance at critical junctures in your personal and professional life. If you have excess credits you may get a tax refund.

The federal government expanded the child tax credit in 2018. Use this tool to get an estimate of. It will not be reduced.

This applies even for a multiple birth so if you have twins born. 6833 per year 56941 per. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

To reconcile advance payments on your 2021 return. The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17.

Have been a US. The benefits are indexed to inflation and are adjusted each year in July. Ad Home of the Free Federal Tax Return.

3750 for each child between age 7 and 16. 6000 for each child under age 7. If the allowance is for the eldest or only child the weekly rate is priced at 2180.

You can keep claiming until theyre 20 if they stay in approved education or training. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 8250 for each child with a severe disability.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Two Child Benefit rates are available for parents to claim. A family can get up to.

5903 per year 49191 per month Examples. Rate weekly Eldest or only child. See what makes us different.

Child Tax Benefits From Daycare To Swim Lessons Swim Lessons Lesson Art For Kids

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

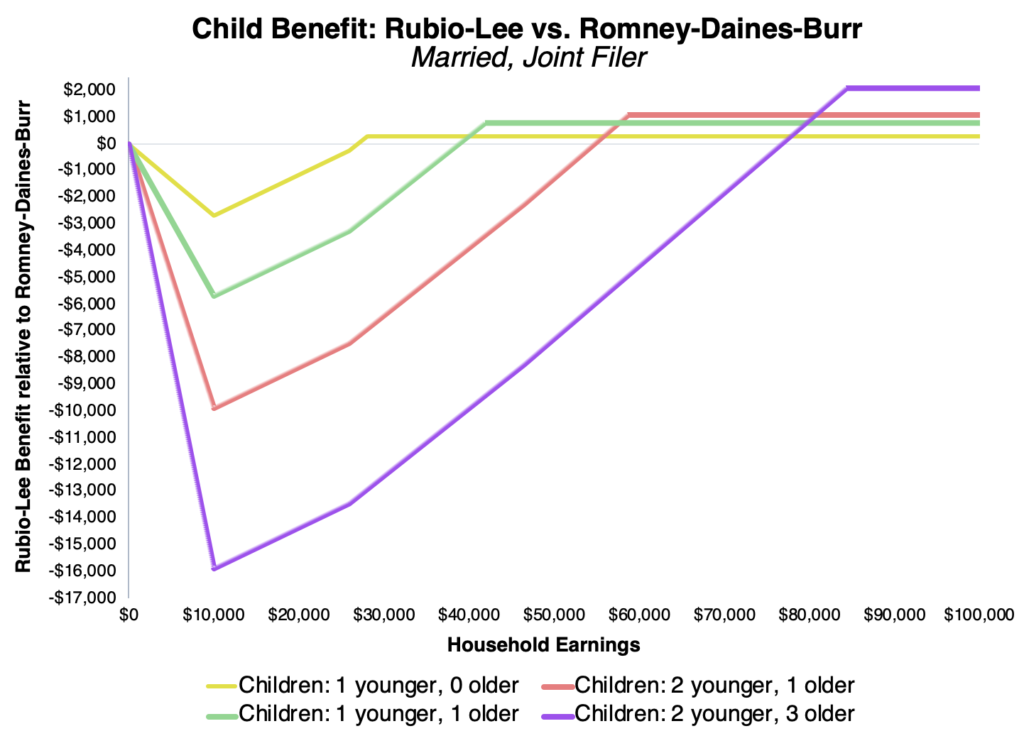

Comparing Rubio And Romney S Child Benefit Proposals Niskanen Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Romney S Child Allowance Improves On Biden Proposal People S Policy Project

/cdn.vox-cdn.com/uploads/chorus_asset/file/6522525/Child-benefit-comparison.0.png)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

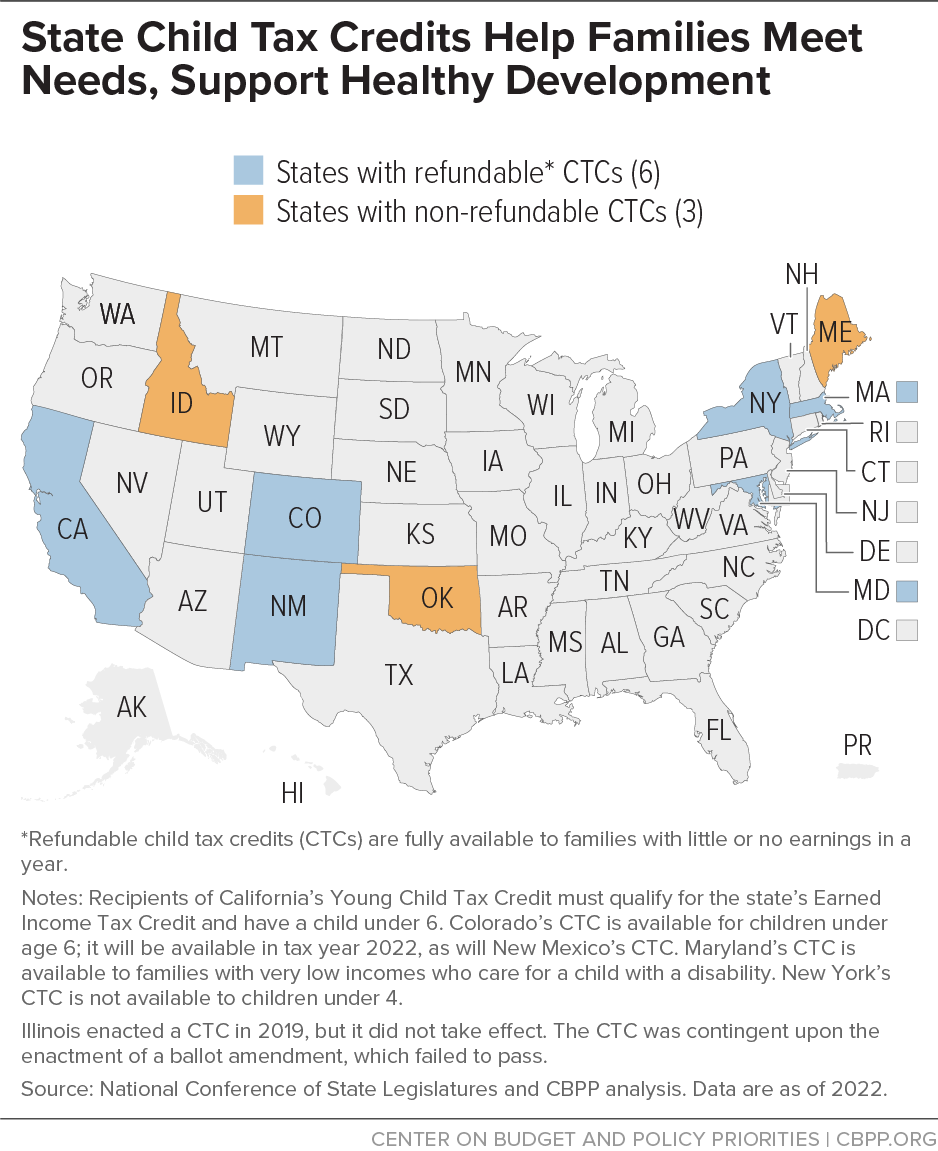

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

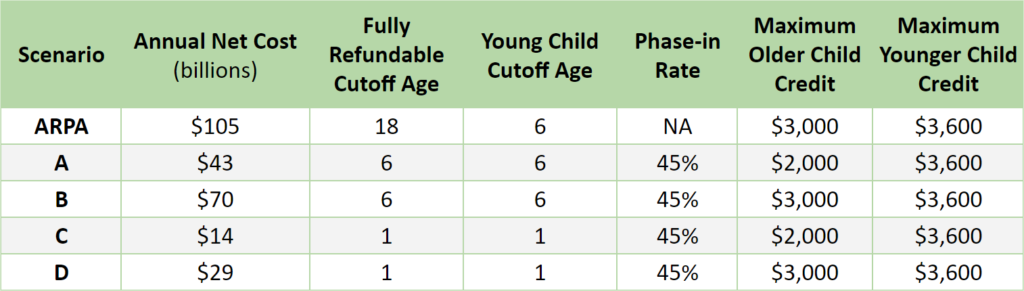

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/6521033/working-family-tax-credits-1.png)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/6520933/child_allowances_chart.jpeg)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

The Child Benefit Building Blocks Infographic Allowance For Kids Money Advice Infographic Health

The Canada Child Benefit Is Getting A Boost In 2022 Eligible Families Can Get Almost 7 000 Narcity

What You Need To Know About The Child And Dependent Care Tax Credit Tax Credits Tax Essential Oil Samples

Child Tax Credit Definition Taxedu Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/22278947/Screen_Shot_2021_02_03_at_1.22.58_PM.png)

Mitt Romney S Checks Plan Up To 350 Per Month Per Kid For Parents Vox

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Cash Benefit Could Help American Families Now Deseret News

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning